The 1st trading week of March was not easy for our Automated Trader. But it made it again: yet another profitable week in our forward test that has gained over 5,000 pips in the test running since October 2020.

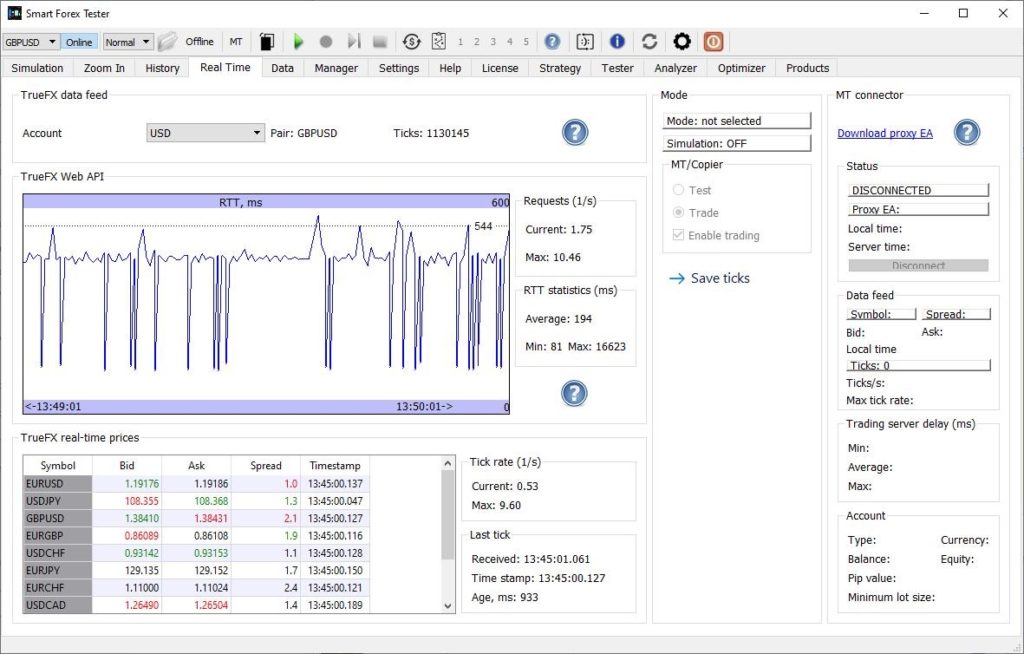

The Cable was not traded very actively this week. We can see that our trader only received 1.13M ticks. We’ve seen this number reaching 1.5M during more volatile weeks.

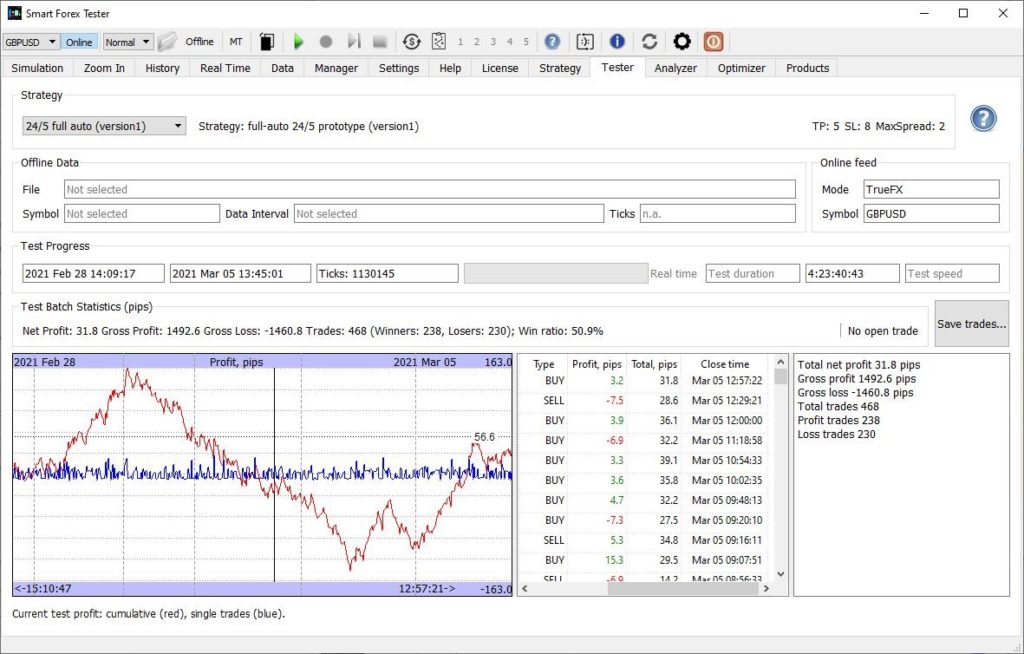

The trading results are shown on the below screenshot.

If you want to dig deeper, here is the full trade log.

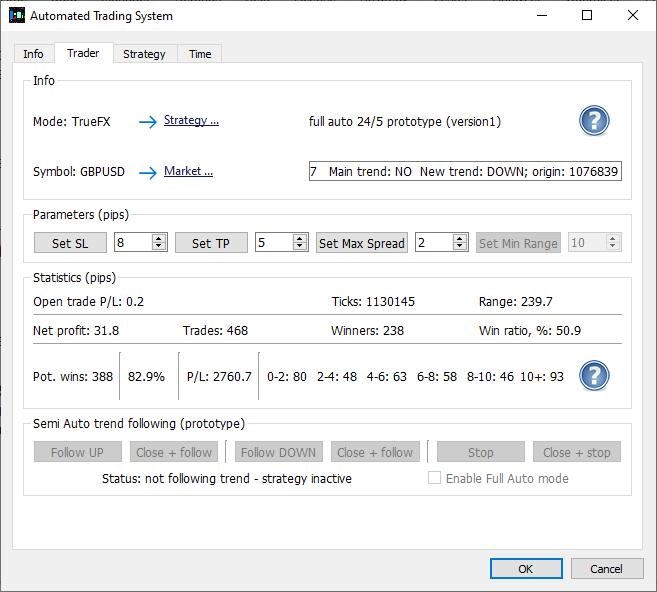

Note that the “potential wins” exceeded 82%, which is even better statistics than usual. Confirming once again that our PPA based market entry signals as such are excellent.

Also this statistics witnesses that the market was choppy with not big enough up- and down moves.

Because our version1 strategy is only starting trailing once the current profit exceeds the TP value, which has been 5 pips during the whole test.

So, if the trade profit reached 4.9 pips or less, and then the market reversed, this trade would become a loser. And there were 150 such trades!

Another explanation for this week result that we can think of is some performance issue in our test bed.

For some yet unknown reason, the average RTT that used to be around 100ms now was 190 ms.

Meaning that the trader could fetch up to 70% less ticks from the TrueFX server than it used to. Which definitely influenced the ability of the trader to react to the market moves.

We are investigating what caused the issue. But one thing is clear – the strategy turned out to be resilient to this, which is good.