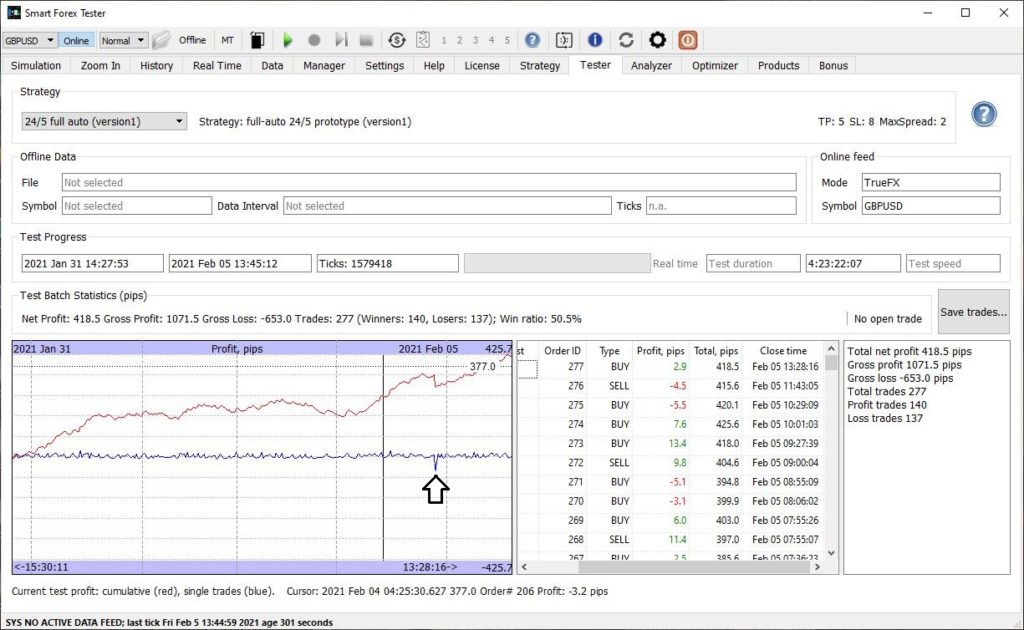

In the beginning of February we again had a familiar pattern that we observed during the end of 2020. Our automated strategy delivered 50.4% win ratio and steady profit growth without big drawdowns.

The weekly profit was double the volatility (193 pips).

A curious event happened on Thursday. Usually spreads widen drastically after the New York trading session ends. This time the spread increase was so big and happened instantly, so the strategy could not close the open trade with the standard SL of 8 pips. Instead, the loss for this single trade was 50 pips.

However, this is a known issue with the current prototype strategy which doesn’t have any scheduler and since we keep our test on 24/5, every day there is a risk of such losses.

For more detail, download the full trade log.