Compared to the great previous week where our Trader yielded 418 pips, this week was rather bleak – total result is only 2.2 pips profit.

However, given the lack of market action, we can consider this result decent – for a trend-oriented strategy that we are forward testing. (See how we test).

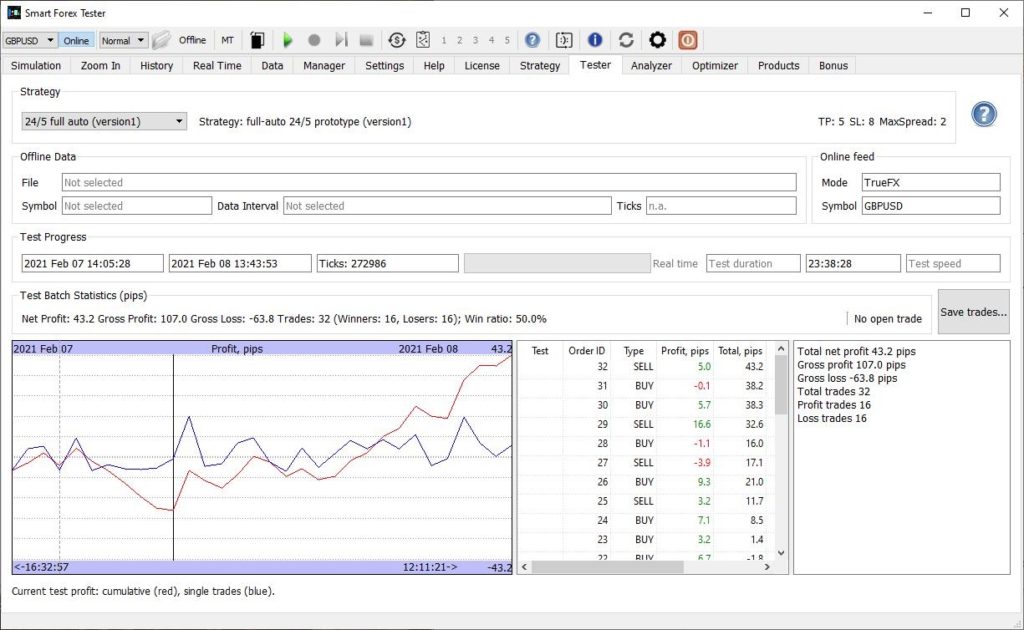

The beginning of the week yielded 43 pips profit and win ratio of 50%. Which is a very good result given the extremely low volatility of only 80 pips.

After initial drawdown of about 20 pips in the first half of Monday European trading, the strategy nicely recovered losses and steadily gained over 60 pips.

If you want more details, check out the full trade log.

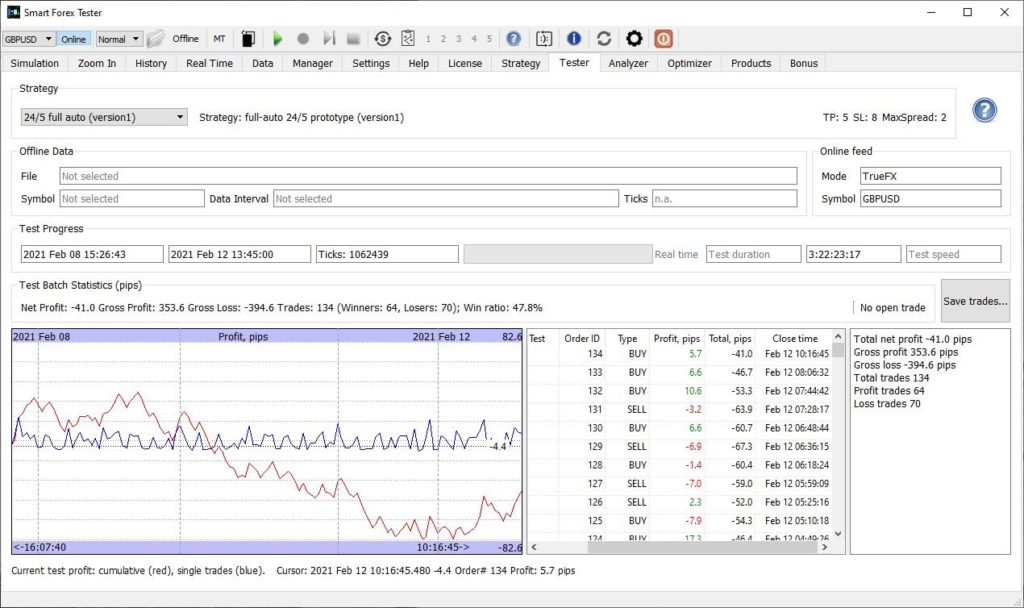

We had to stop the test just before the end of the Tuesday NY session. We resumed the test after about 1.5 hours (which was wasted time anyway from trading prospective) and kept it running uninterrupted during the rest of the week.

End of Monday went very well – the strategy won additional 30 pips in a nice steady manner. Tuesday was a calm day with almost no action.

Then difficult times started. During Wednesday and Thursday we lost almost 100 pips in the same steady pattern. One of very rare cases of a big drawdown.

Friday was an up day with almost 40 pips gain.

Full trade log for the second part of the test.