We have been systematically testing our automated trader since October. On the same currency pair and also keeping the trader parameters the same.

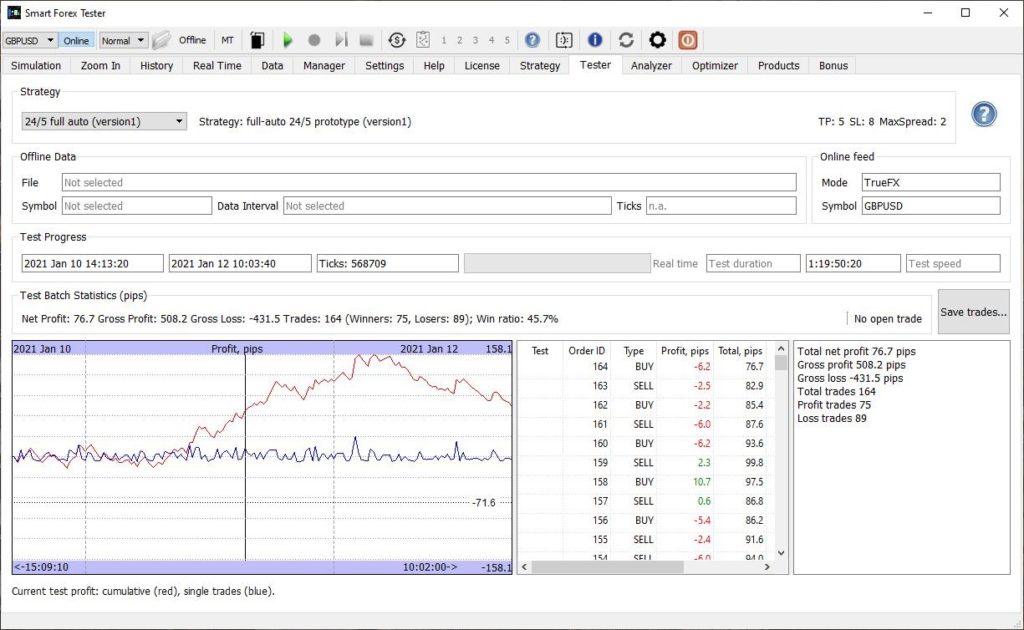

The first two trading days’ results are shown below. Here is the full trade log.

The volatility in this part of the test was 187 pips. Monday was a fabulous day with over 100 pips profit and nice equity curve.

But from the second half of the London session on Tuesday, the strategy had one of the worst losing streaks we recall and gave back almost half of the 160 pips gain it had made from the beginning of the test.

Due to a technical glitch in our system, the test stopped in the second half of the NY session. We restarted it couple hours before Frankfurt open.

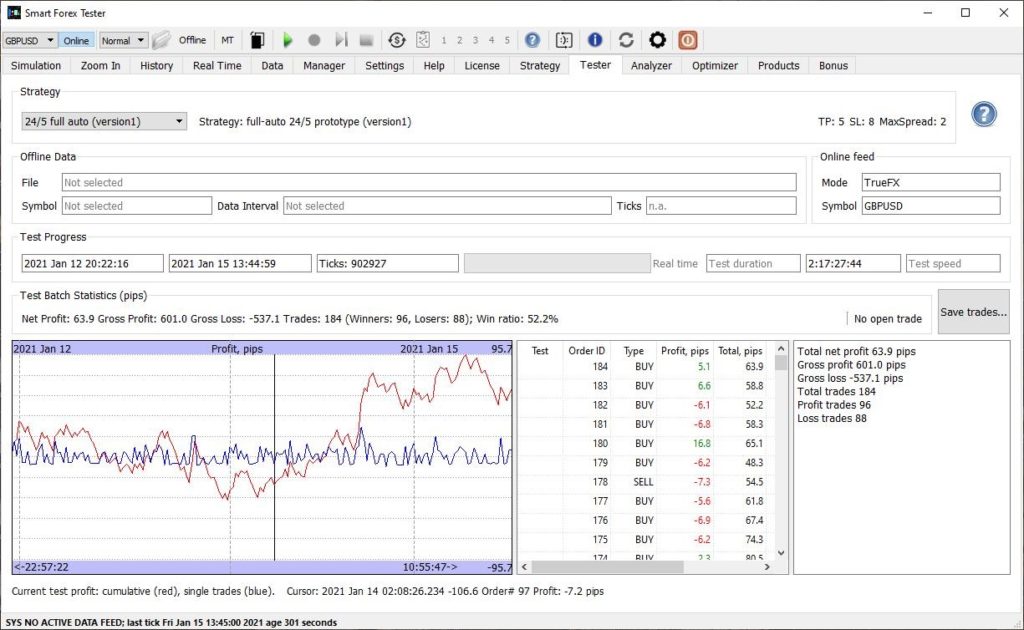

The results from the restart until or the rest of the week are as follows:

In the second part of the week (Wednesday-Friday), the GBPUSD volatility was considerably lower than usual – only 137 pips – and essentially all of it on Thursday. The strategy nicely used this and scored almost 100 pips. The rest of the days the market went nowhere. Here is the trade log.

Bottom line, the week profit was 140 pips. In fairness, we have to mention that we had a 8 hour gap in the second half of the NY session and the first half of the Asian session.

But since it is extremely unlikely that we would have lost over 100 pips in a slow Asian trading, we can safely say that the week was again profitable.