Bottom line: low volatility resulted in sub-optimal trading performance. However the whole week was again profitable.

We continued our forward testing of our automated trading on real-time prices provided by TrueFX. All test parameters were unchanged since our first test.

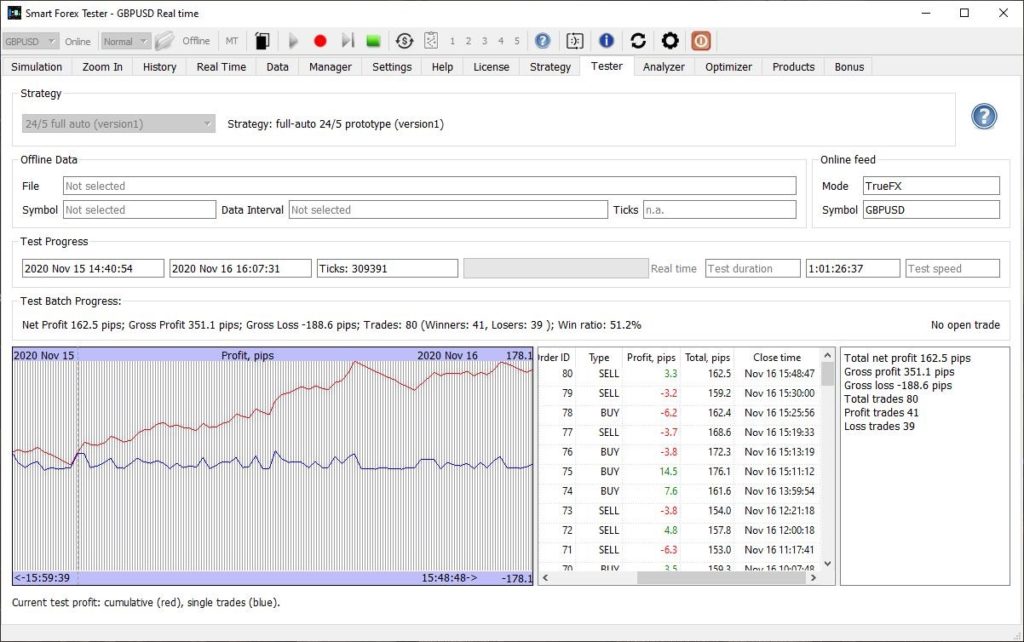

The first trading day of the week was the most successful. The strategy gained 160 pips in 24 hours.

The graph below shows the result from the beginning of the Auckland session on Sunday until the end of the US session on Monday.

Here is the full trade log.

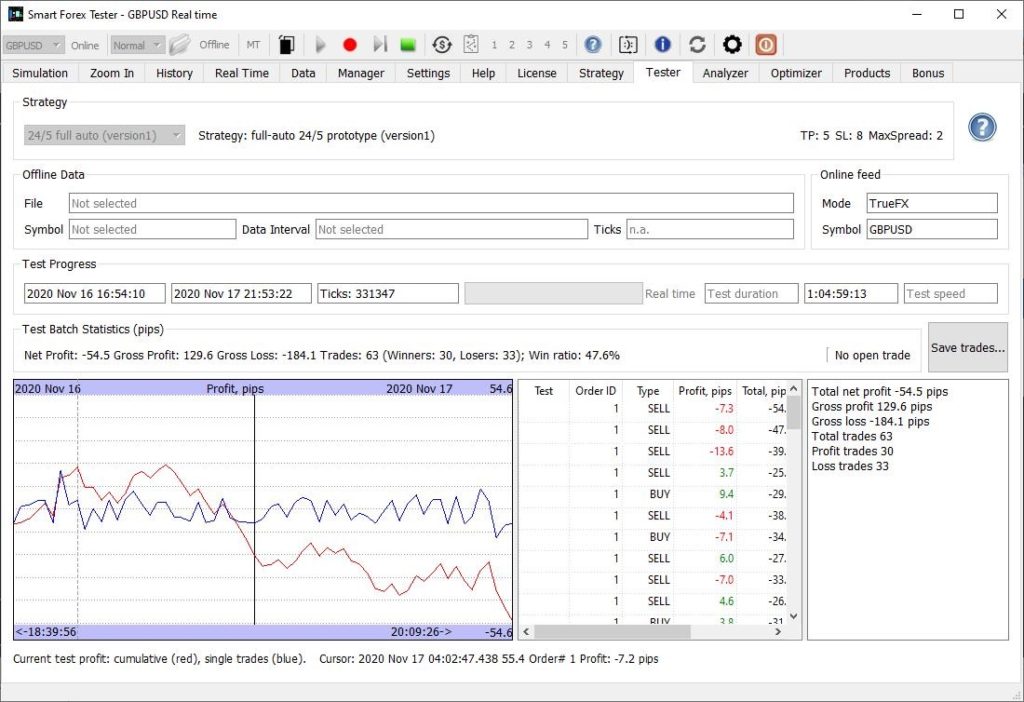

The next two days were losing days. However, in absolute numbers, the losses during these 2 days were considerably less than the win during the first day.

The results for Tuesday are on the below picture. Note we used the newer build so the interface is slightly different.

We can see that losses are limited. In total, we are still nicely up. Trade log.

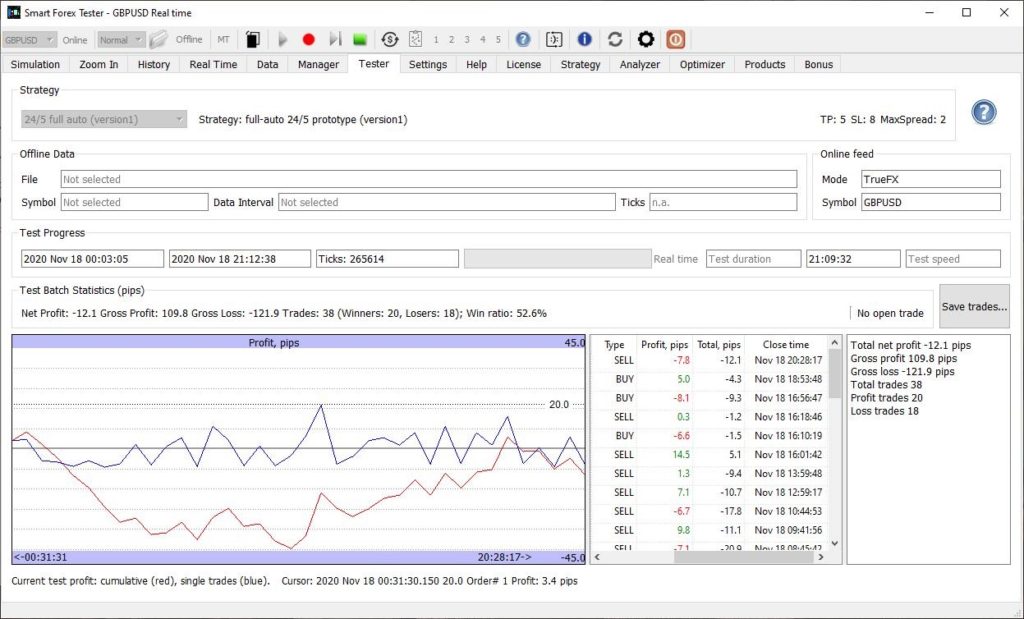

Wednesday was a very slow day. The results presented below.

Again, small loss but we are still up almost 100 pips for the week. Trade log.

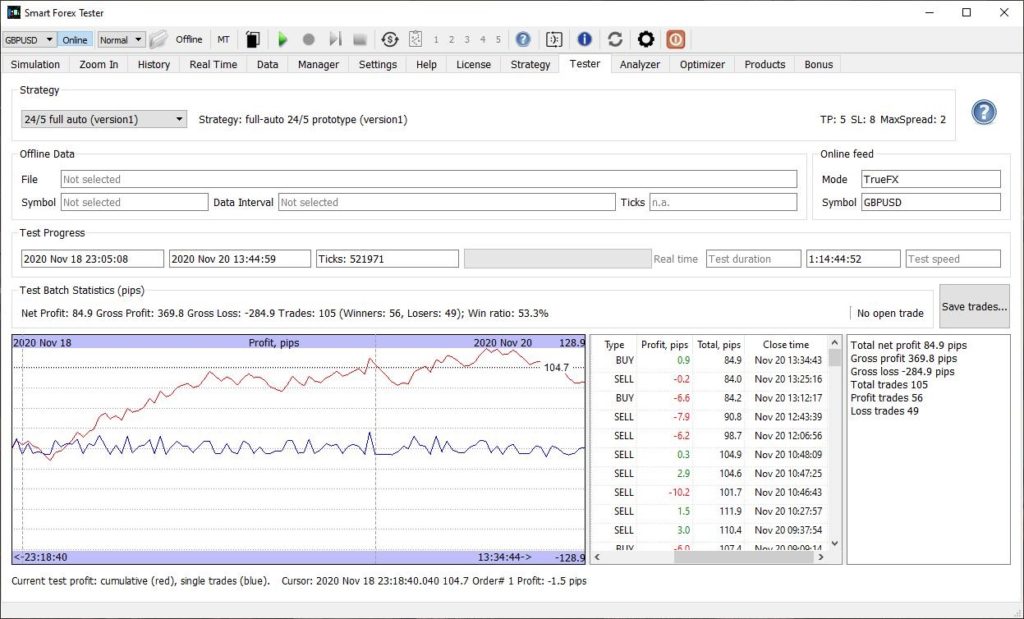

Thursday-Friday results are below.

Thursday was a very successful day – we were gaining steadily and the result was over 100 pips – for volatility of only 86!

Friday was very slow day with volatility under 60 but still we were gaining about 20 pips in the middle of the US session. Though we failed to keep those gains and lost some pips in the end. Trade log.

Summing up, this week was not the best one. Half of the time the market was very slow with low volatility, especially on Friday. However, even in such conditions, our strategy managed to win – just shy of 200 pips, which is good for such trading conditions.