Last week, we shared the result for the new version2 trading strategy baseline forward testing.

Today we can share an update.

We made a slight modification to the baseline strategy and the result was 50% better than the one we posted for the baseline version. The modified version scored 220 pips vs 144 pips for the baseline – with zero absolute draw down.

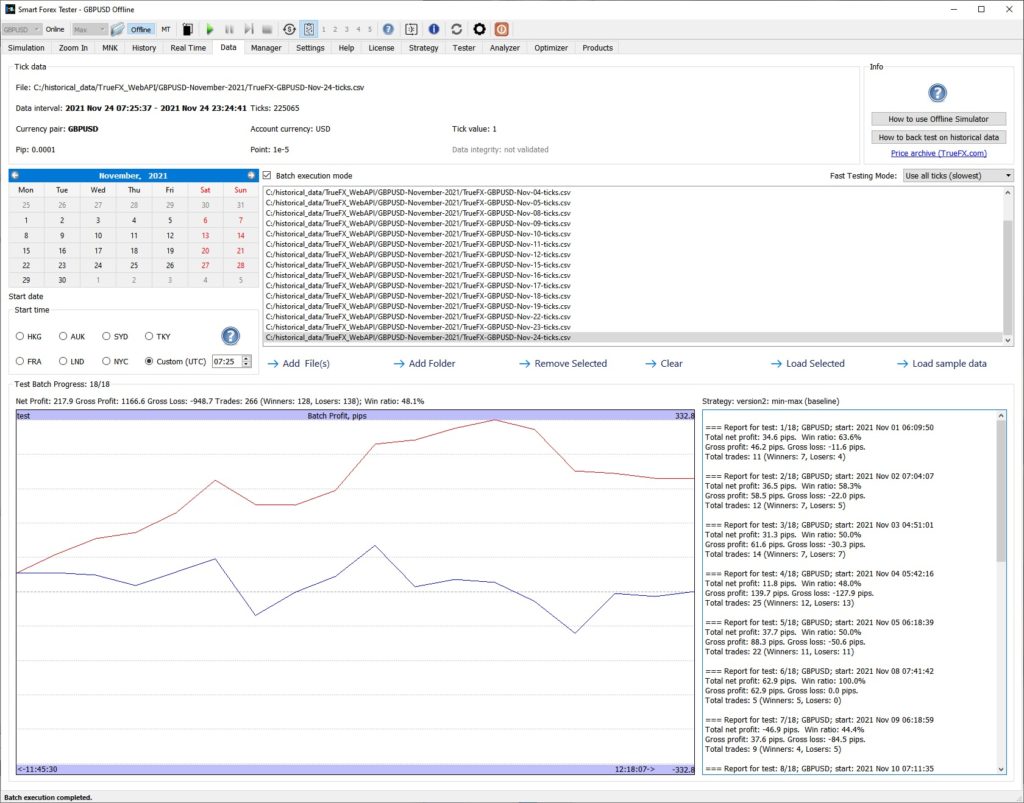

The data set used was the same as in the previous test, except that we added 3 more days (11/22-24). But these extra days didn’t change the main result – see the horizontal part on the right hand side of the graph. Which was kind of expected during the holiday week. The market was basically threading water.

You see the same November 19 “blind spot” as for the baseline. If you want to compare with the baseline test, here is the trade log.

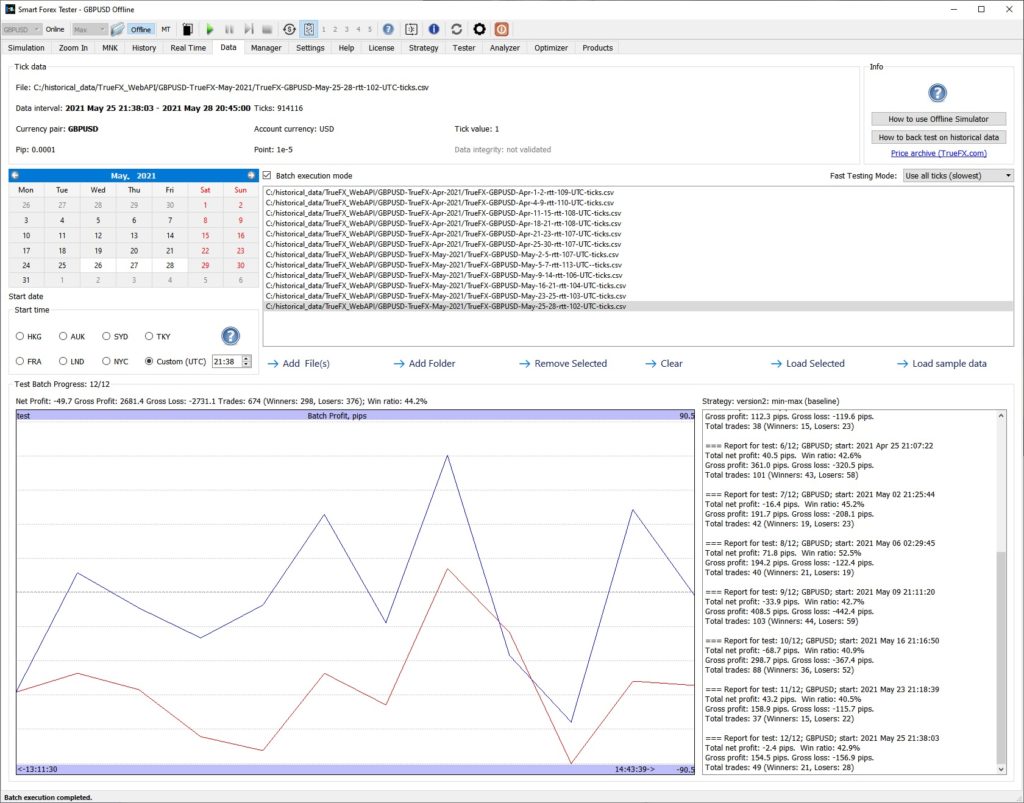

However, the most interesting about this modification was its performance in our April-May 2021 06.00-18.00 UTC test, where the baseline of the version2 lost 376.8 pips.

The modified strategy cut the losses by over 300 pips – and the draw-down was not bad, either. See the screenshot below.

This is a stunning development – because this modification didn’t yet address the “blind spot” issue!

So, in the April-May 2 month test the modified strategy nearly recovered from over 500 pips blind spots losses. You can check out the details in the trade log.

We will research and test this more before publishing. Stay tuned!

Could you advise when the enhanced version2 will be released? Would it be provided as part of an update to the current V3 application?

Thank you

Hello David,

We will be releasing version3 strategy this year. It includes even more enhancements. Since the “blind spot” issue has not yet been addressed, we will be including controls to mitigate it in semi-auto mode. We will publish a post on version3 soon. Stay tuned!

Dear Sir,

Thank you for your email.

I am interested in your EA.

Can your MT4 EA “tick-trade” Bitcoin, Ethereum, etc 24/7 using IC Markets and FXCM and AvaTrade and IB Brokers(Chicago)as Brokers?

Or maybe use all 4 Brokers simultaneously, using the same EA Settings, all on VPS’s (for safety)?

What return could be expected from your EA trading these “Synthetics” if zero-leverage is dialed in……could we expect say 33% per year?

Looking forward to hearing from you.

bet,

J W Sydney, Australia.

Hello John,

Yes, if you have the symbol in your the MT4 client terminal. For example, we are currently testing BTCUSD on ADSS feed and the results are in line with our GBPUSD testing. Using our trader on multiple feeds simultaneously is also possible: we currently don’t lock the software license to a particular hardware.

With regard to returns, please review our test results on the blog. For example, on GBPUSD, our latest strategy won over 200 pips in 3 weeks of November. Which is ~40% annually without leverage. This is with a new version2 strategy which is currently under development.