Last month we published our new version2 trading strategy and also shared the test results for modified version2. Which were slightly better.

Now, we have made some more improvements to vesion2 and we decided to release them as our next version3. It is available now in the latest software.

Version3 main difference from its predecessor is that one of the 2 entry/exit conditions is made less restrictive, so that it works faster. Which was found beneficial in our testing.

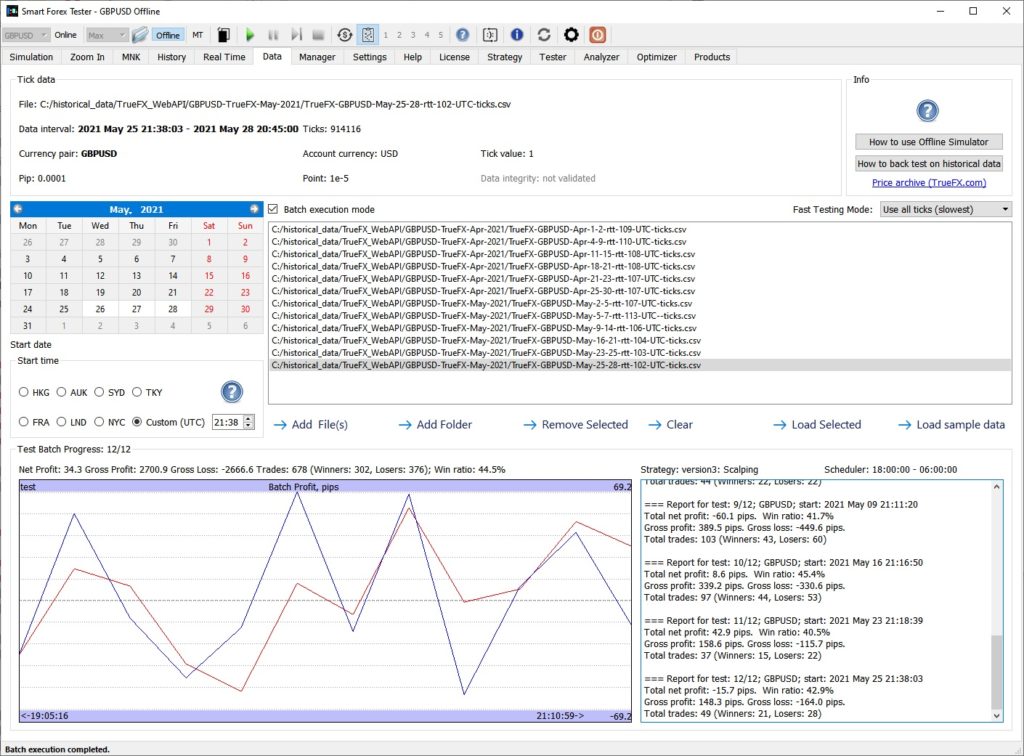

To compare the new trading strategy with the previous versions, we ran our standard April-May 2021 GBPUSD 06.00-18.00 UTC test. Version3 turned out to be the best out of the 3, and it was also profitable in this test.

You may say that the result is nothing to write home about. While we would agree in general, still it is important to notice much better draw-down pattern than that for version2 (which also lost about 50 pips). And version3 is light years ahead of version1 that lost hundreds of pips in this test.

You can repeat the test with the GBPUSD tick data shared earlier on the blog.

Version3 does not yet fix the “blind spot” issue we observed in version2. If you check the details in the trades log, you will find about 10 trades that lost the entire stop-loss (we set it to 60 pips). To say nothing of multiple trades with smaller but still sizeable losses that were closed by the scheduler before they had time to hit the full stop-loss level.

As we showed in the post about version2, in many of these cases losses could be cut by at least half by manually closing the positions. Do the math.

Due to the issue, it makes little sense to bulk test the strategy in the full-auto mode: the results will be dependent on the number of position locks. But even with the issue we see the potential in version3, so we continue to work on it.

What is a blind spot? It is a code logic error. It is very easy to fix. That said, every fix we tried worked worse in our tests than the code without a fix. The reason is as follows.

Most often blind spots happen when a powerful trend starts in the direction opposite to the open position and then the position most probably either hit the stop-loss or will be closed by the Scheduler.

One possible solution would be to accept the error and close the position immediately when a blind spot is detected; and forbid new orders until the market hit the stop-loss level of the closed position. If we could do that, we could have cut hundreds of pips of losses.

The problem with this approach is that sometimes, when the markets fluctuate without clear direction, a blind spot might also occur – and it may go away on its own and then our positioning will eventually prove correct. But if we close the position in this case, we would lose a lot of potential profit as well.

So, better approach for the automated strategy would be to try to recognize a powerful trend and reverse the position. In this case we could count on profiting more from correct positioning than losing from wrong decisions.

While we are working on the improvements, we decided to add controls to help using this trading strategy in semi-automated mode.

When the issue occurs, we print the warning, and we also draw a horizontal line at the lock level. If the open position is a BUY, the blind spot won’t dissipate on its own as long as the market stays below the black line. For a SELL position – above the line.

We might also add a sound indication later, if deemed necessary. Let us know.

In the most important cases you can easily tell when a new powerful trend started. So, you can make corrections immediately.

What to do. First of all, disable automated trading in the direction of the currently open position. Use the checkboxes on the Simulation tab. For example, if you have a long position, uncheck the Allow BUY box. This is needed as a precaution measure, because when you close the position, the automated strategy can open a new one without any warning.

Next, monitor the market and wait for a good time to close the open position manually with minimum losses. If you succeed to catch a convenient pullback, you can manually open the opposite position immediately after.

Now, when you are positioned properly, keep in mind that the position is monitored by the automated strategy. Which may close it when the exit condition is met.

If you are actively monitoring the situation, depending on your priorities, you can manually override the strategy again: if you uncheck the Allow CLOSE box, your order will be active until you close it yourself (or check the box back).

Sounds complicated? Try it in the offline simulator. Start any test at full speed from the Tester tab, and when you hit a blind spot, reduce the tick feed speed to 4X (or 2X, depending on the market action). You will quickly understand that the procedure we described is actually pretty straightforward.