The President Day week turned out to be a disaster.

Our automated strategy lost 390 pips. There were no winning days. The win ratio was lowest on record and at times fell below 40%. That said, we are still up on in February – thanks to the nice 400+ pips gain during the 1st week!

This was the first such a serious blow to our strategy during the whole test that we have been running since October 2020. (See how we test).

Before this week, in the entire 5 month long test, we had only 2 losing weeks. First, we lost 15 pips during the New Year week. And the other time was when we lost 27 pips during the Thanksgiving week.

We intentionally run our test 24/5. But in real trading, holiday weeks should probably be skipped.

That said, the Christmas week was an exception when we scored a massive 900+ pips profit.

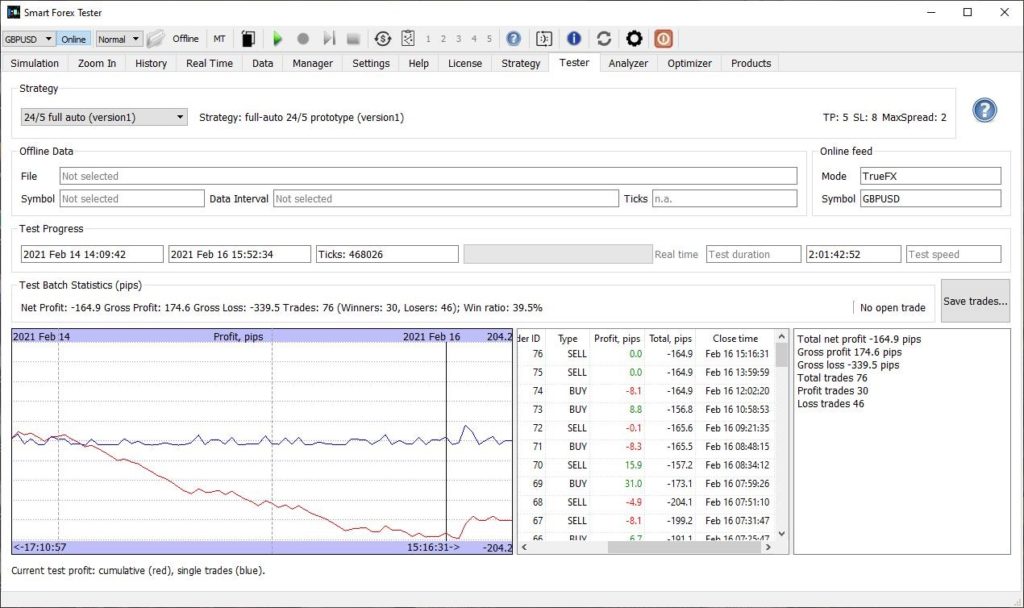

Here is the profit development from the beginning of the trading thru Tuesday NY session (Monday was the President Day holiday in the U.S.).

If you want to see the details, here is the full trade log.

Quick analysis shows that the price action was very unfavorable for our trend-biased automated strategy. While the overall volatility for these 48 hours was 129 pips, for the most part it was too low.

The below graph shows an example. Only 20 pips range for 15 hours is extremely rare.

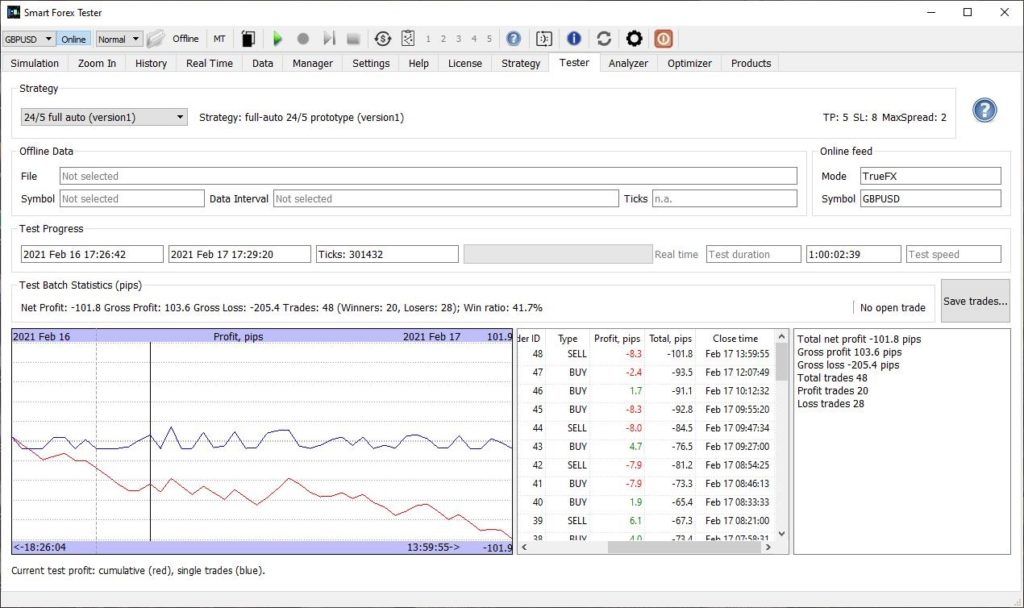

We restarted the test and kept it running for the next 24 hours. Full trade log.

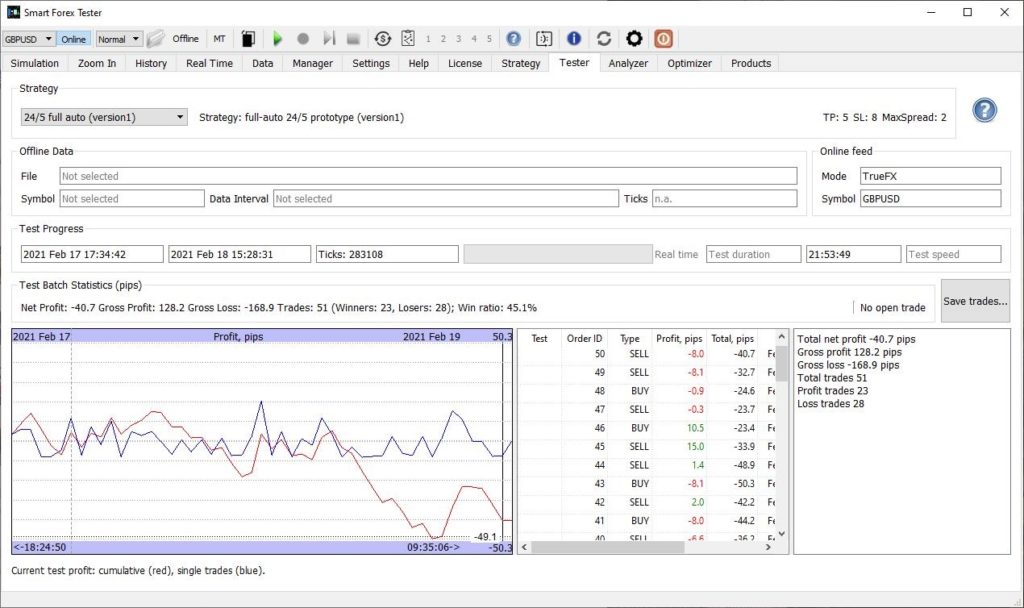

The test was again restarted and ran for another 21 hours. Full trade log.

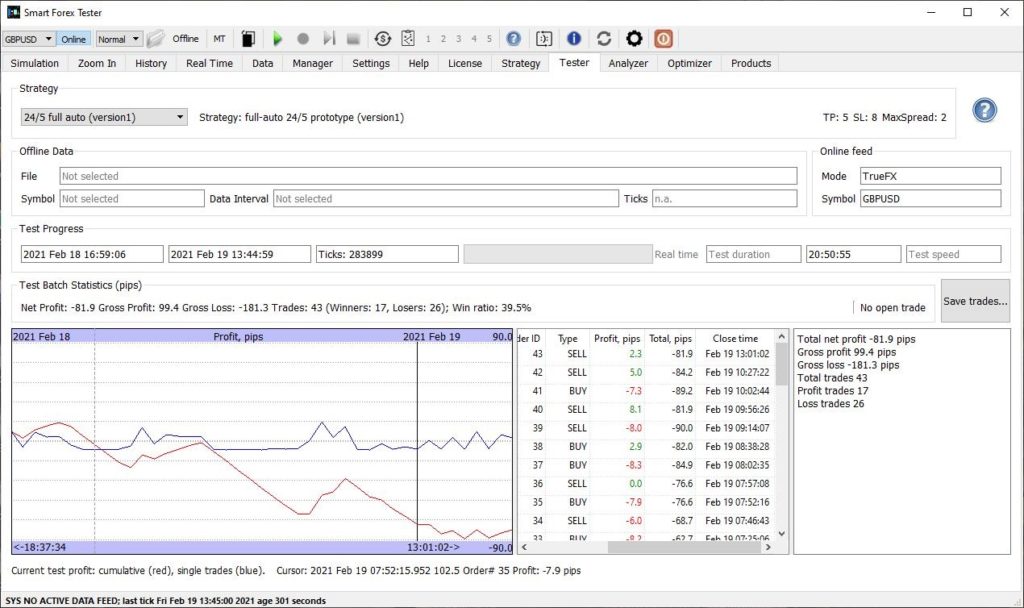

And here is the graph for the last 20 hours. Full trade log.

While this week is definitely an outlier in our nearly 5 month test, it shows again we need to make the strategy more robust.

Good news is that we have already started testing the first version of mean reversion algorithm. Next step is the switching logic that would select the most relevant strategy based on the current market conditions.

And let’s see how the last week of February goes. So far we are winning a little on a monthly basis. And based on our previous statistics, we are optimistic that we will have 5th profitable month in a row.