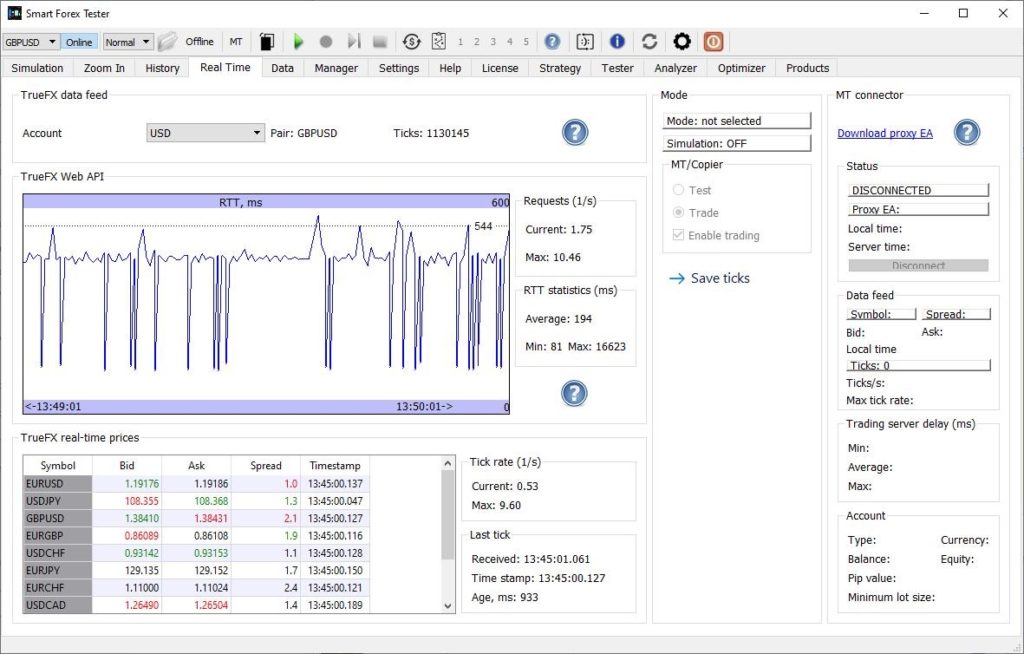

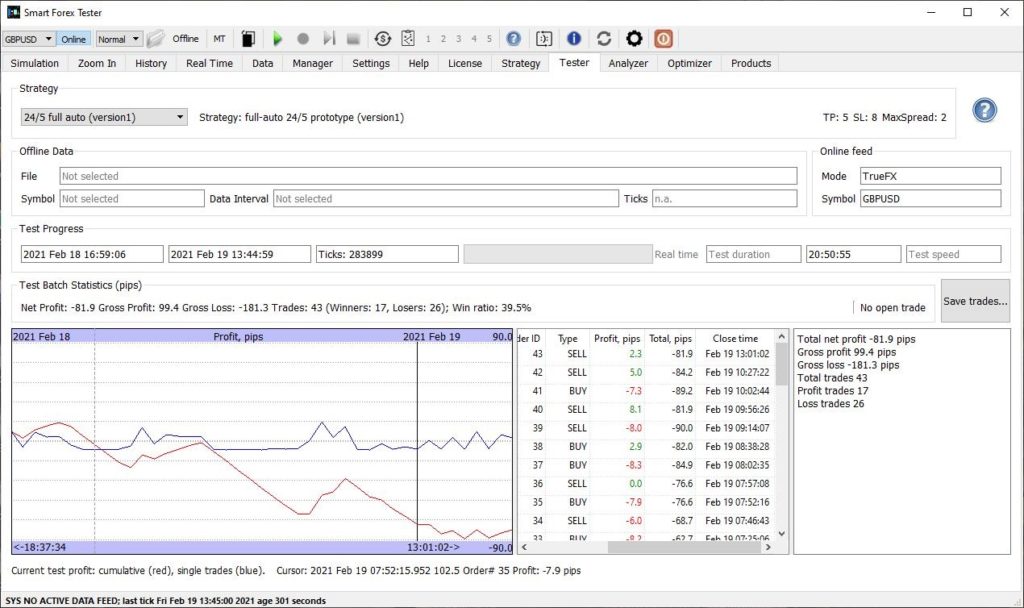

With the Cable going nowhere this week, we decided to try Eurodollar for a change. We used the same strategy and parameters as in our continuous 5+ month GBPUSD forward test.

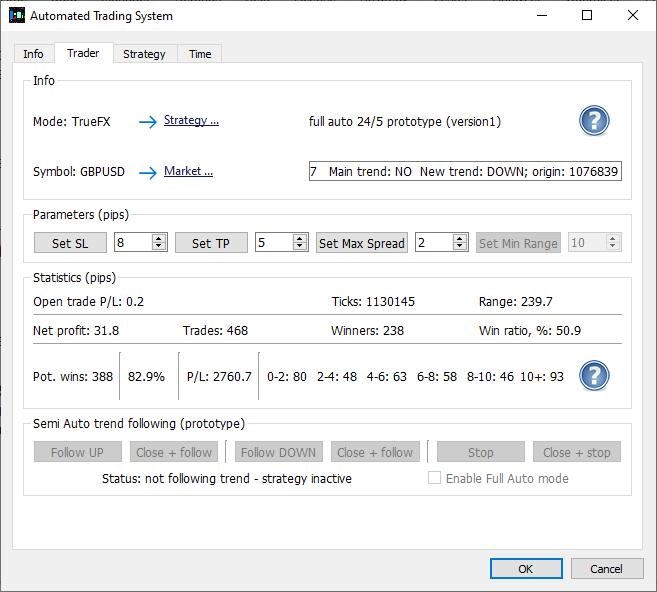

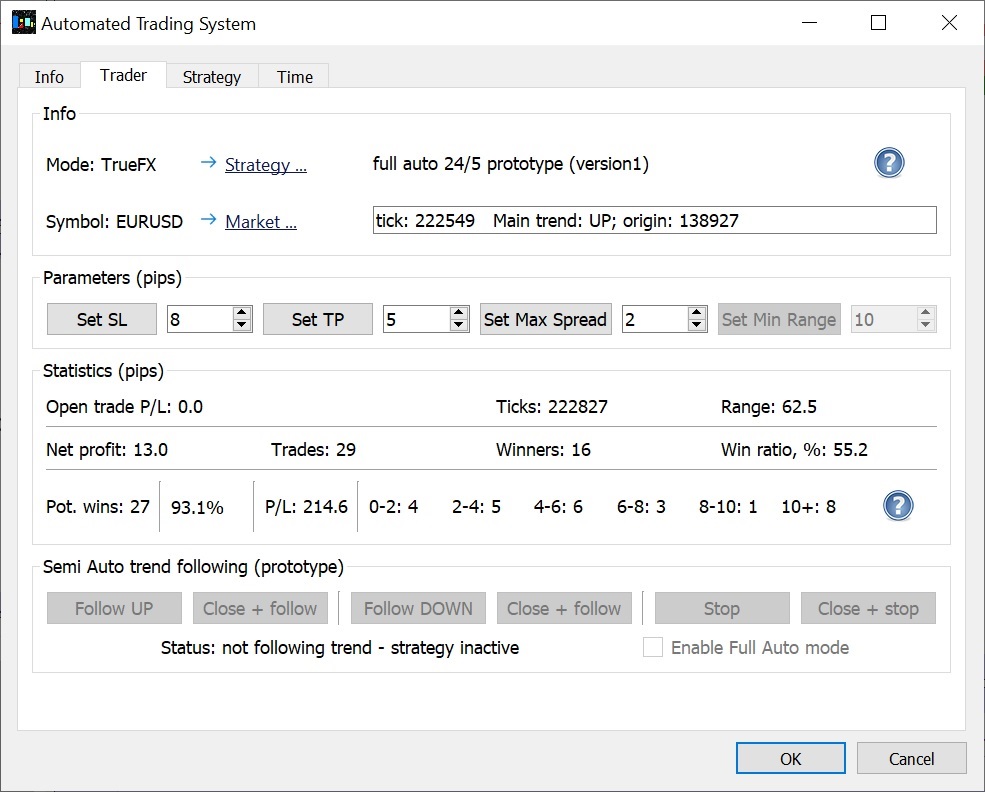

Namely, we used the version1 strategy with TP=5 and SL=8 and MaxSpread=2 pips. PPA parameters were set to 100/100/254/5/15 (top to bottom).

While SL is static in the version1 strategy, TP is not. Once the current profit exceeds the set TP value, the strategy moves the SL level to the breakeven and starts trailing – but slower than the profit grows. This prevents the strategy from closing the trade too early.

The MaxSpread parameter forbids entering the markets if the current spread exceeds the set value.

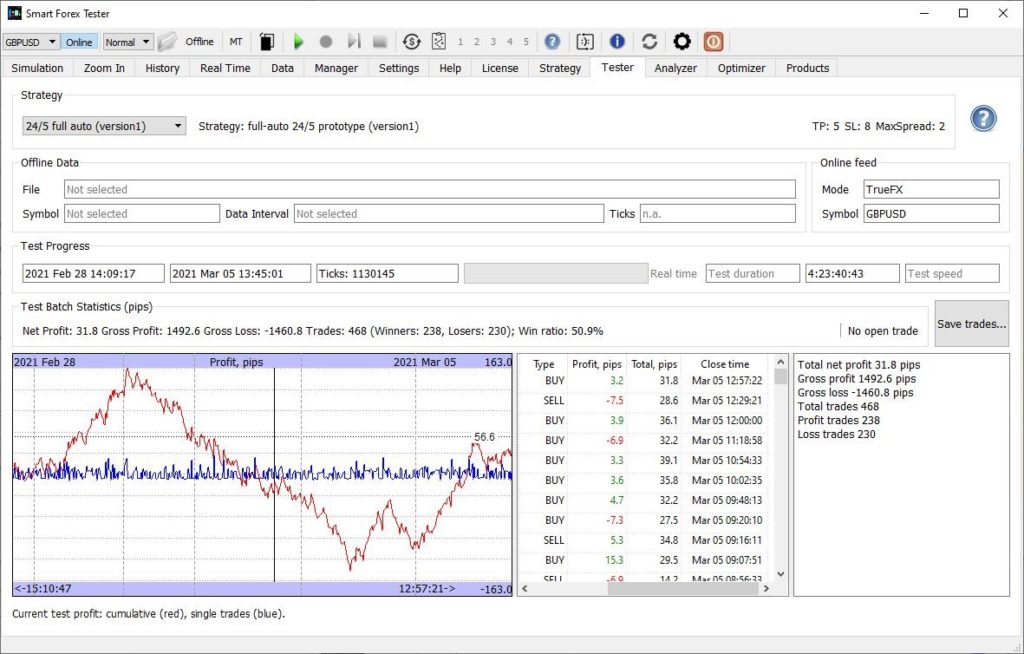

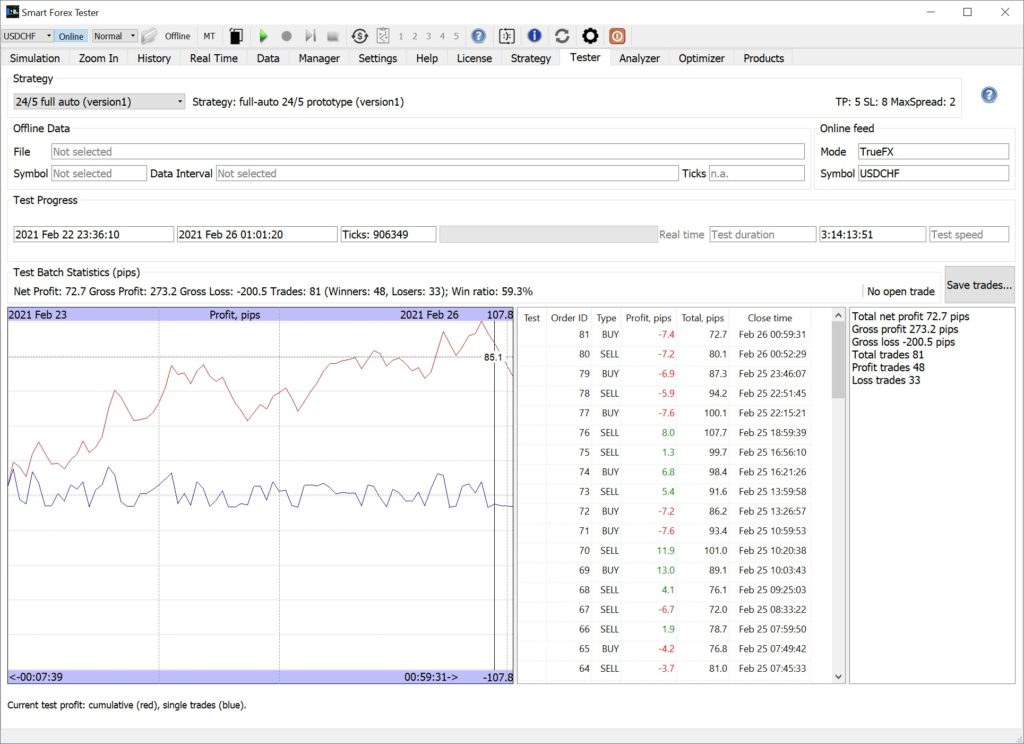

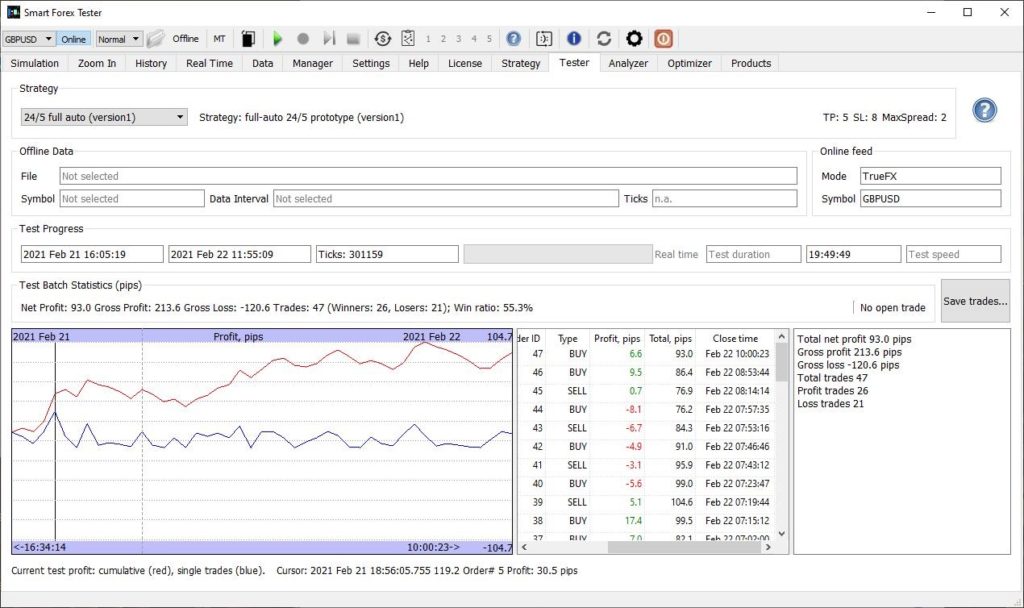

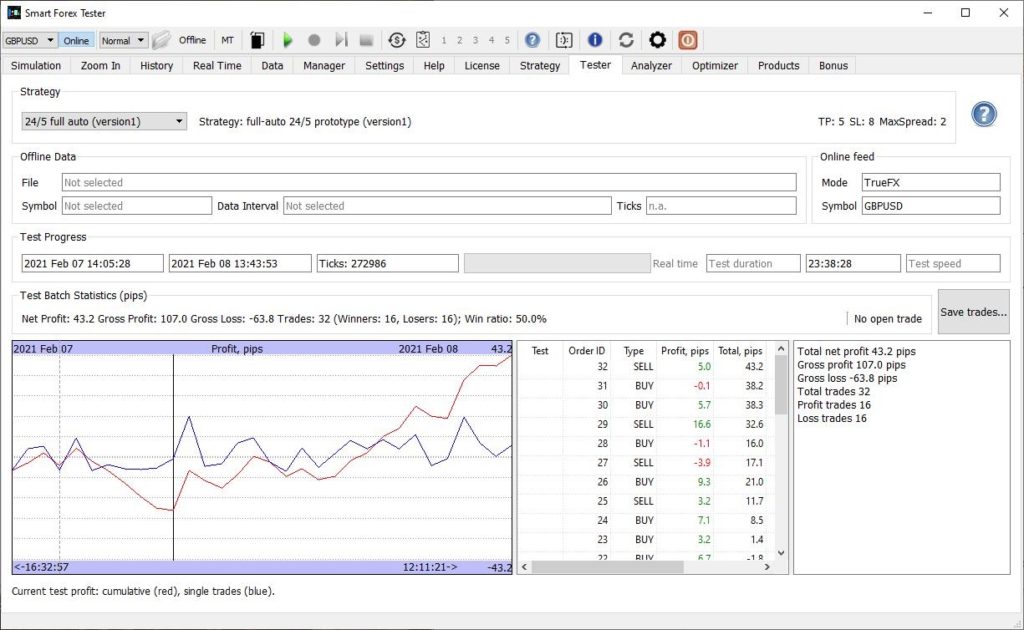

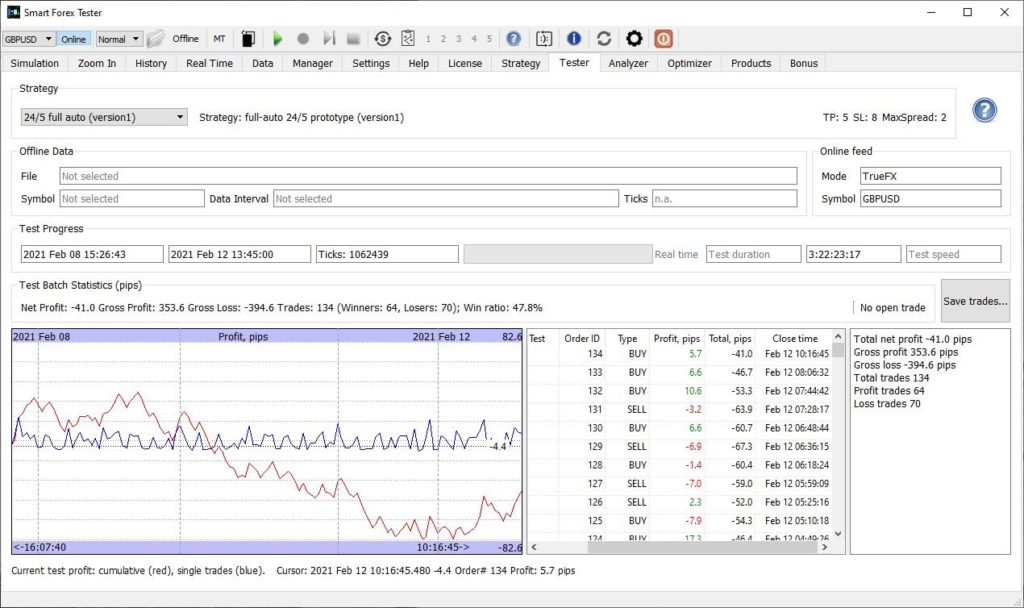

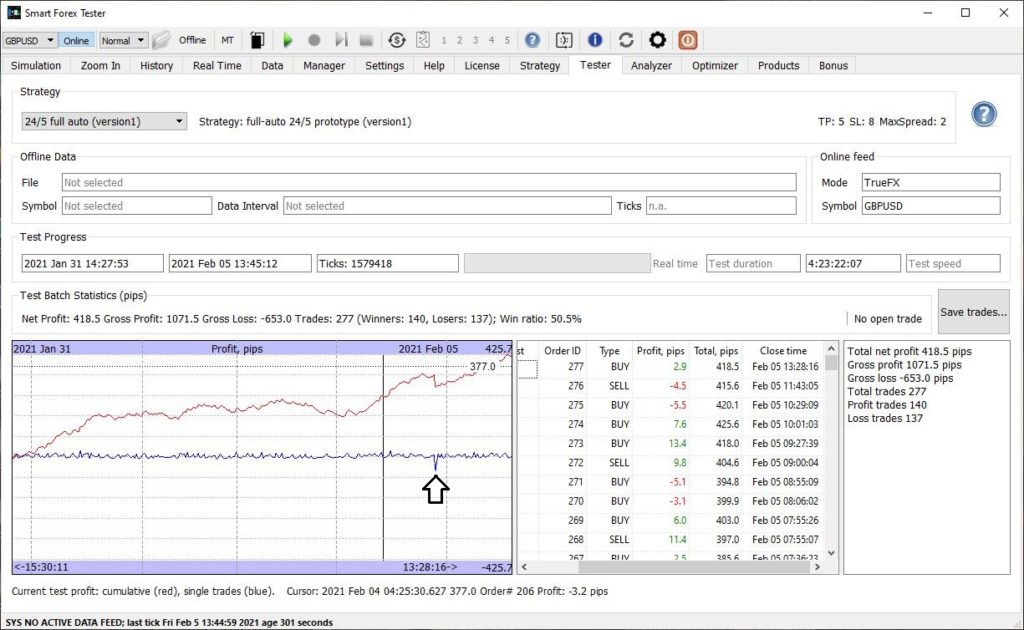

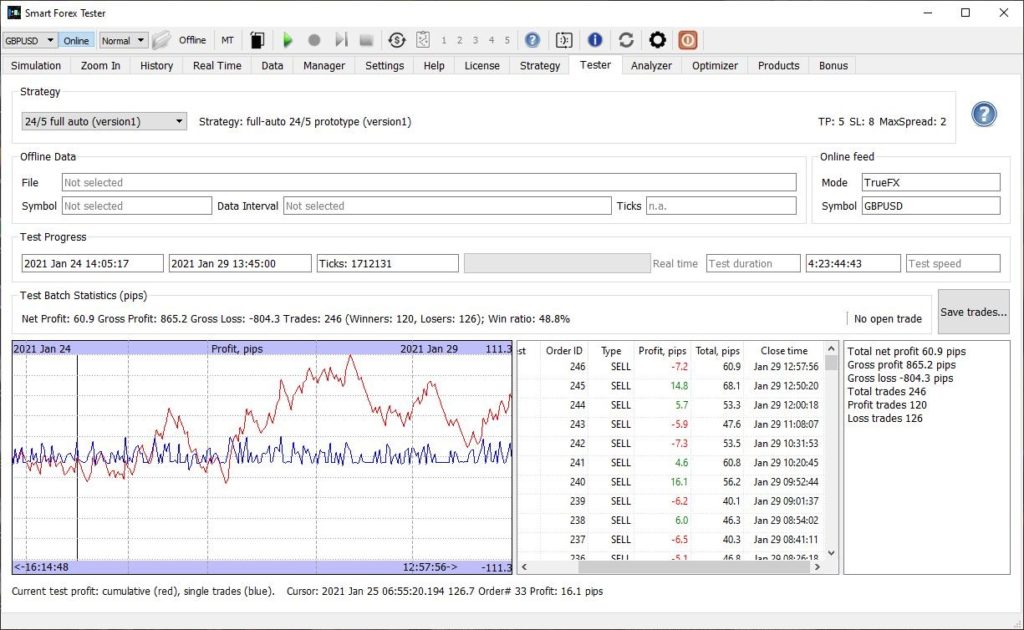

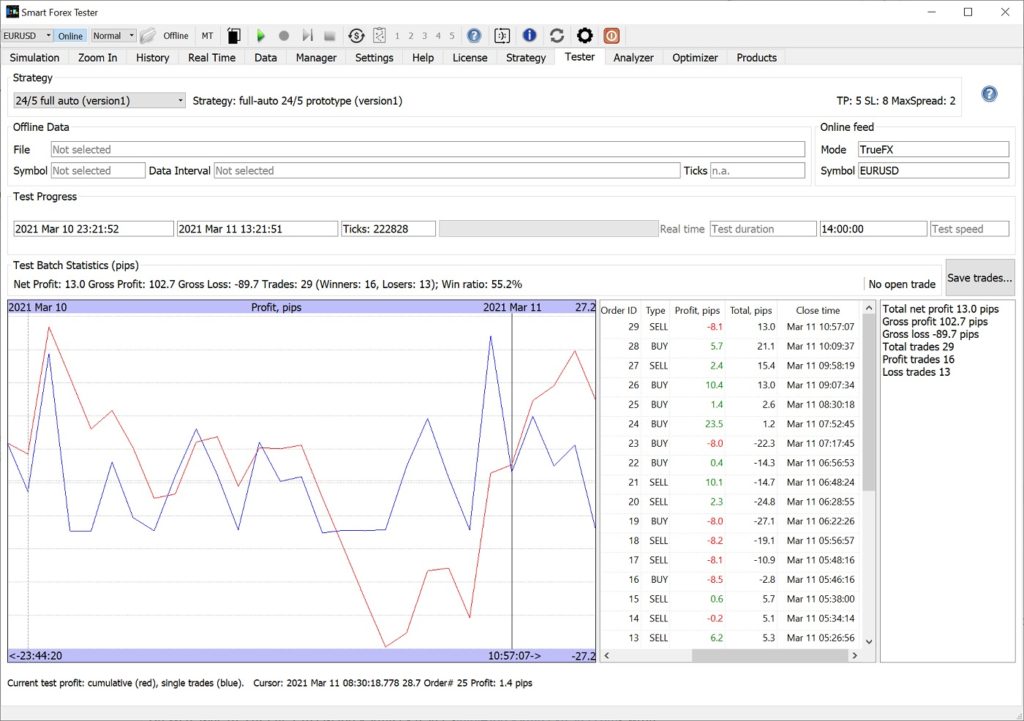

Below is the test results. The version1 strategy delivered decent 55% win ratio and even for very low 63 pips volatility scored 13 pips of profit.

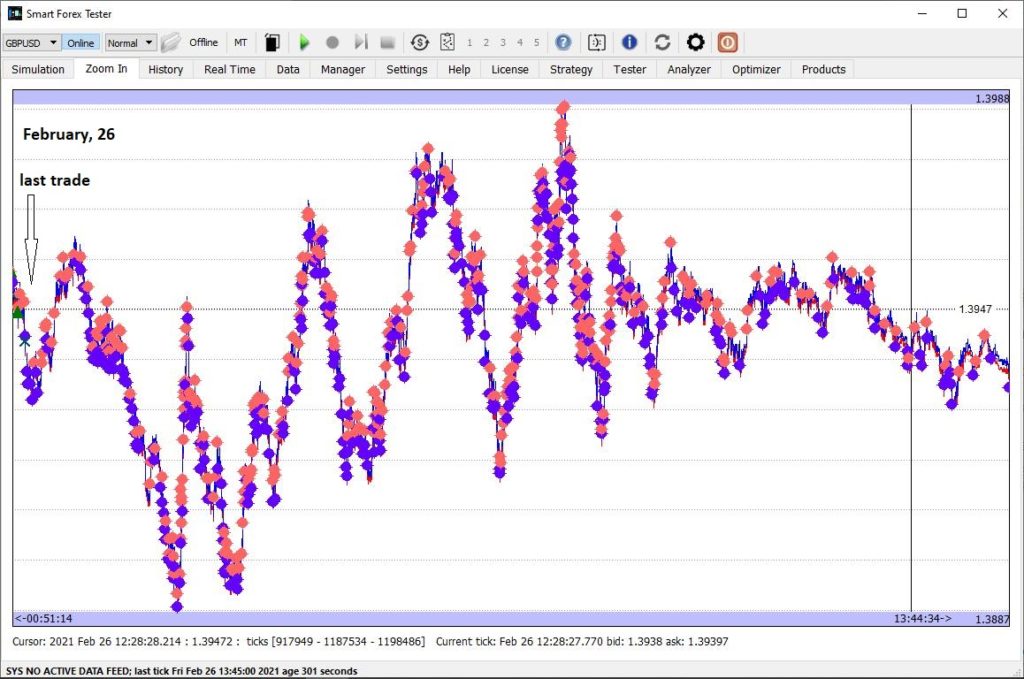

This can be attributed to the “clean” price action with big enough up and down moves without much overlapping. This is what the version1 is most suitable for.

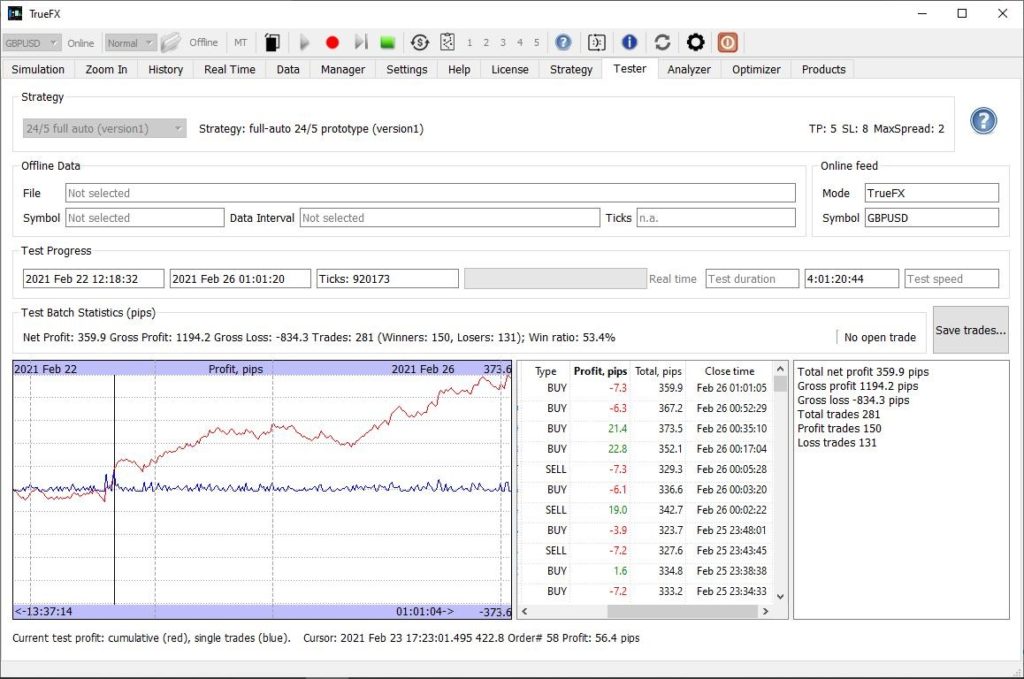

Even more interesting is the potential wins statistics. At closing of each trade, the software checks if the trade could have been closed with a profit, and logs how many pips we could have won.

We can see that out of 29 trades, we could have closed 27 with profit. Which means the market entries were nearly ideal.

But the strategy could only win 16 trades – meaning the profit taking logic definitely deserves improvement (which is one of the things we are working on).

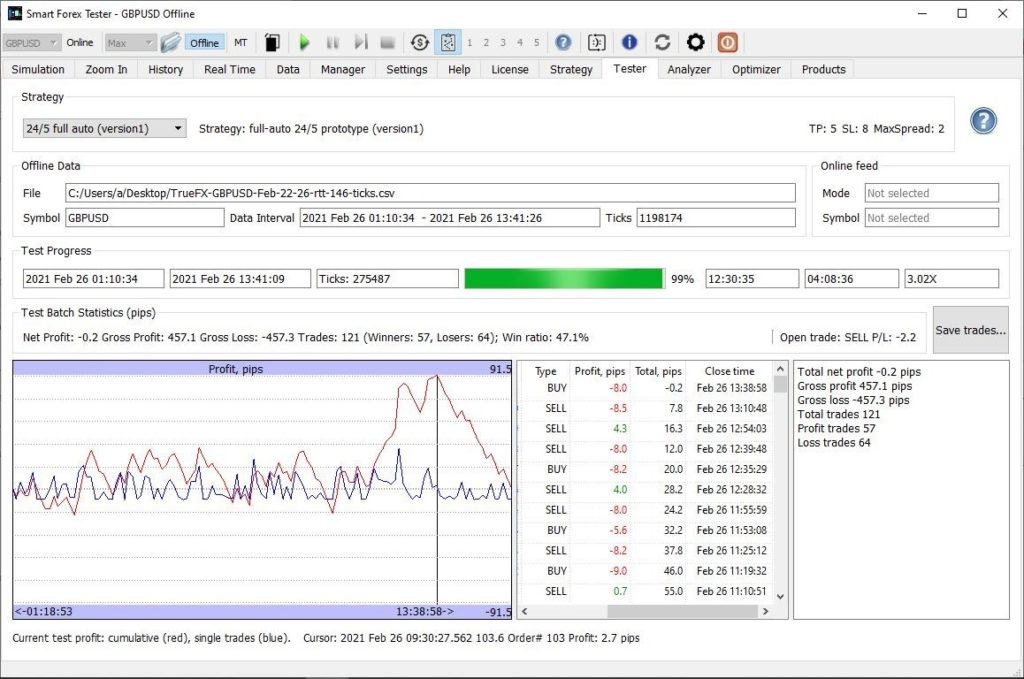

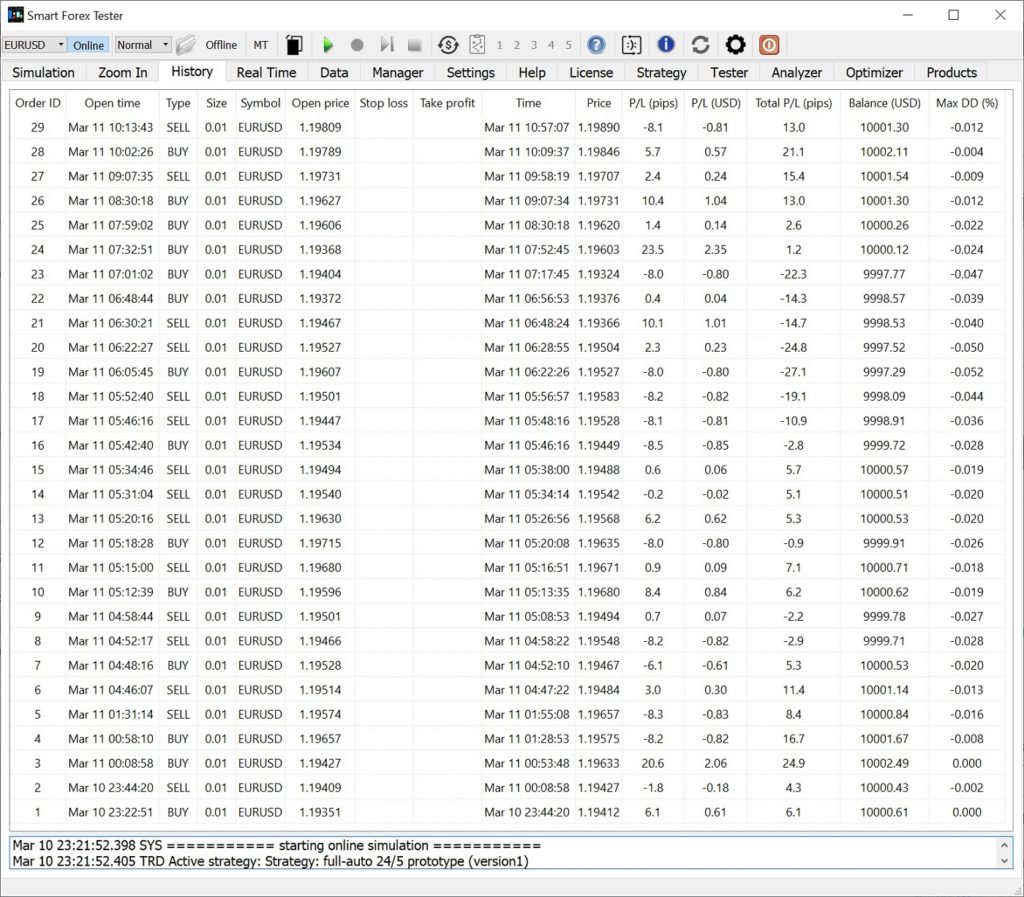

If you want to get into details, you can review the trades on the screenshot below. You can also download the full trade log.

Want to replay our test in the offline simulator? Use the tick data file that we recorded.

In case you may want to run a similar forward test yourself, we compiled the step-by-step instruction how to forward test, where we also explained in detail the GUI controls, gauges etc.

If you don’t yet have the software, you can get it here.